A Blog About Gen-X Women Preparing for Retirement

Financial Freedom and Endless Vacations

It's Time for Gen-X to Get Serious About Retirement Planning

Ok Gen-X, here we are. We made it through feral childhoods, drinking from the hose, riding in the back of pick-up trucks, and running the neighborhood with our friends until the street lights came on. We grew up, some of us married and raised families, and some of us, unapologetically, choose not to.

We’re the latch-key kids, the lost generation, the sandwich generation, and we are soon to be the retired generation.

Many of our generation have lived through divorces, remarriage, blended families, and taken care of our parents as they aged.

Unlike our parents who likely worked for one or two companies their entire careers, and were able to earn a pension, we have moved around. Changed jobs, and even switched careers. Some of us even had to reenter the workplace later in life and are at a big disadvantage both in income and savings.

On these pages, we are going to talk about where we are, where we want to go, and how we’re going to get there.

First, let’s look at some of these stats.

Dude, Where’s Your Money?

Did you know that more than 30% of Gen-X members don’t think they’ll be able to retire at 65?

Or that 56% of Gen-X’ers have less than $100,000 in their retirement accounts.

According to this newly released Prudential survey, Up to 30 million, 46%, of Gen Xers do not think they will have enough saved to live comfortably in retirement. Those fears reflect Gen X’s savings reality: 35% have less than $10,000 saved, and 18% — reflecting up to 12 million Gen Xers — have nothing saved.

Almost half (47%) of all working Gen Xers expect to retire later than anticipated. Forty percent plan to work part-time after retirement.

69% of Gen Xers want to retire before age 65, but only 37% think they’ll be able to retire by then and nearly 40% of Gen X aren’t confident they’ll be able to afford to retire at all.

Only 12% say an inheritance will be a source of retirement income, even as boomers are expected to pass down over $70 trillion. Demonstrating that wealth has been concentrated at the very top of the economic ladder. 84% of Gen Xers don’t think they’ll have enough funds left after retirement to leave an inheritance.

Let’s talk about Social Security. It’s been projected that the Social Security trust fund reserves could be exhausted by 2033. Despite this alarming forecast, a surprising 58% of Gen Xers are banking on it as a significant source of their retirement income. It’s clear that the security blanket of Social Security is not as secure as it once was.

Pensions, once a reliable source of retirement income, are becoming a thing of the past. Only 20% of Gen Xers plan to use pensions for their retirement income, with a mere 11% intending to rely mostly on a pension. This mirrors the dramatic 73% drop in the number of pension plans between 1985 and 2020. The pension safety net appears to be shrinking rapidly.

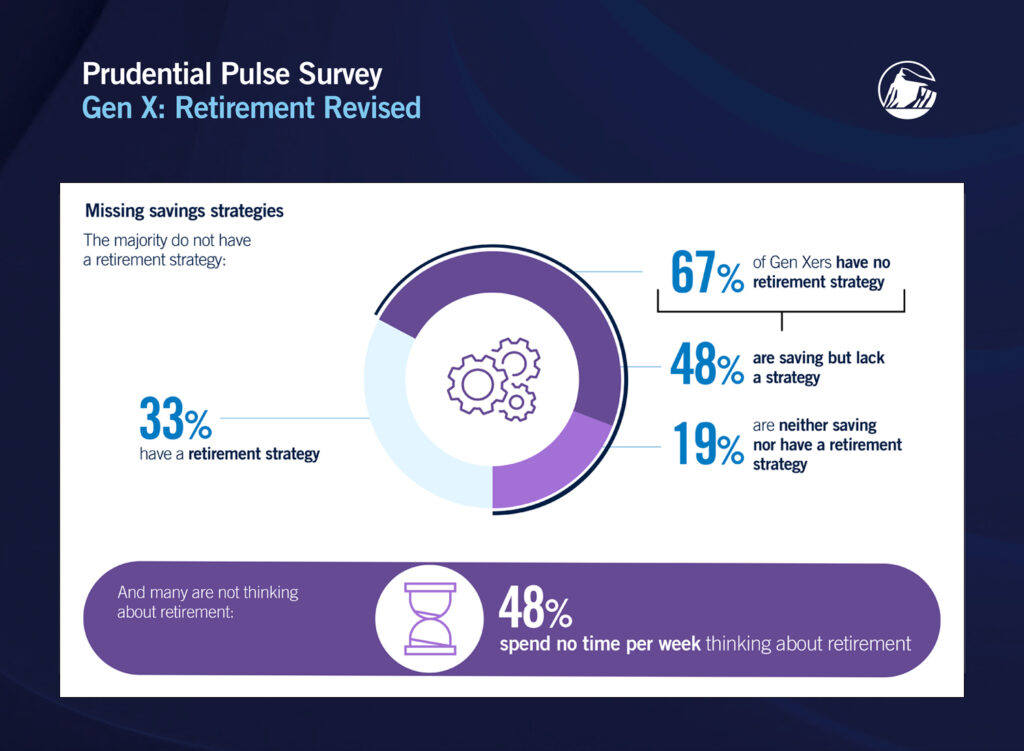

Alarmingly, almost half (48%) of Gen Xers are saving for retirement without a concrete plan. This lack of strategy could lead to financial instability down the line.

Inflation is another significant concern for our Gen X readers. A whopping 68% of working Gen Xers are worried about reaching their savings goals due to inflation. Furthermore, 72% feel that the current economic climate makes it difficult to plan beyond day-to-day expenses.

Job security is another pressing issue. While economic downturns are still the biggest threat (35%), fears of being replaced by younger (29%) and less expensive (26%) workers are also causing anxiety.

We can’t overlook the critical expenses that many Gen Xers are failing to account for. Nearly two-fifths (38%) are not factoring in healthcare costs, and a staggering 75% are not accounting for assisted living expenses. These are significant costs that can severely impact retirement savings.

Gen Xers are facing a unique set of retirement obstacles. It’s crucial to start planning and saving strategically to navigate these challenges successfully.

Gen-X Women Face Unique Obsticles

Gen-X women are 53% more likely to have nothing saved for retirement than Gen-X men.

Whether due to leaving the workforce to raise children or take care of aging parents, the gender pay gap, wages not keeping pace with inflation or the loss of a second income due to death or divorce, Gen-X women have found it difficult to make ends meet much less have much left over to save for retirement.

Recommended Reading: Embracing Retirement with Enthusiasm: A Celebration of Gen-X Women

The facts surrounding Gen-X’s retirement plans sound bleak, and there’s a good chance that if you landed here from a search about retirement, you’re concerned about your retirement situation as well.

There is good news. We still have time! Everyone wants to convince you that if you didn’t save from your twenties, you’ll have to downgrade your lifestyle or run out of money. Nothing could be further from the truth.

You Don’t Need Savings in Retirement, You Need Income.

Even people who retire with fat retirement accounts, don’t spend their savings, they spend the income generated by those savings. Likely dividends or a set amount pulled from the returns. They leave their capital to continue earning income.

Even people who retire with fat retirement accounts, don’t spend their savings, they spend the income generated by those savings. Likely dividends or a set amount pulled from the returns. They leave their capital to continue earning income.

If you haven’t amassed a pile of capital by now, (and most of have not!) the best course of action is to start generating passive income online that will continue to pay you throughout your retirement years.

If you’re concerned that you won’t have enough money in retirement, we have a plan!

The Retirement Revolution: Why Passive Income Beats Traditional Savings

Face it. If you’re over 40 and haven’t been saving since you started working, chances are slim that you’ll be able to “catch-up” on retirement savings.

You’ve heard the old adage, “Workers save entrepreneurs invest.” Creating income streams through your own business will always trump savings and here’s why.

Savings, no matter how substantial, is a finite resource. If you’re relying solely on savings during retirement, you’re essentially working with a countdown timer, a nest egg that diminishes with each withdrawal. Even a well-planned budget can face unpredictable expenses, and over time, it’s possible that your savings could eventually deplete. Furthermore, living in retirement worried that your money will run out is not living!

In contrast, passive income sources, if well managed, can provide a continual stream of revenue, akin to an ever-flowing spring. Examples of such income sources include rental income from real estate, dividends from investments, earnings from an online business, or royalties or ad revenue from creative work.

Recommended Reading: Securing Financial Security in Retirement: Why You Should Consider Creating an Internet Side Hustle

The key aspect of these income sources is that they have the potential to generate revenue regularly without the need for active, daily involvement.

Think of it like this – with savings, you’re eating into the capital each time you spend. It’s like consuming a loaf of bread slice by slice; eventually, the loaf will be gone. However, with passive income, it’s more like having a bread-making machine that produces a new loaf periodically. As long as the machine is well-maintained and the necessary ingredients are available, it will continue to churn out bread. This principle is what sets passive income apart and makes it a desirable component for a robust retirement plan.

This continuity of income can add a level of financial security and peace of mind during your retirement years, knowing that you have an ongoing income source that won’t run dry. Click Here to take the first steps toward creating your own online money machine to secure a better retirement for yourself today!

Become an Old Lady in Training Today

Subscribe to My Free Newsletter to be Notified When I Post New Articles

Old Lady in Training’s 4-Step Program to Getting Finances on Track for Retirement

In this section, we lay out a step-by-step plan to take control of your retirement money.

The truth is, 401(k) plans are only good for you while you are working for that company and receiving a company match. Once you’ve left their employ, your money should go with you. If you left your 401(k) funds behind at your former employer or just had them roll them over for you with their choice of broker, chances are very good that money isn’t earning for you the way it should.

For instance, unless you gave instructions to that broker otherwise, your funds are probably sitting in a low-earning mutual fund or worse, as cash. You need to direct those investments once you aren’t in a 401(k) anymore.

Don’t know where to start?

Follow this 4-Step Plan to gain control of your hard-earned retirement money, get it working optimally for you, and back on track.